Tax Costs… Are You Seeing the Bigger Picture?

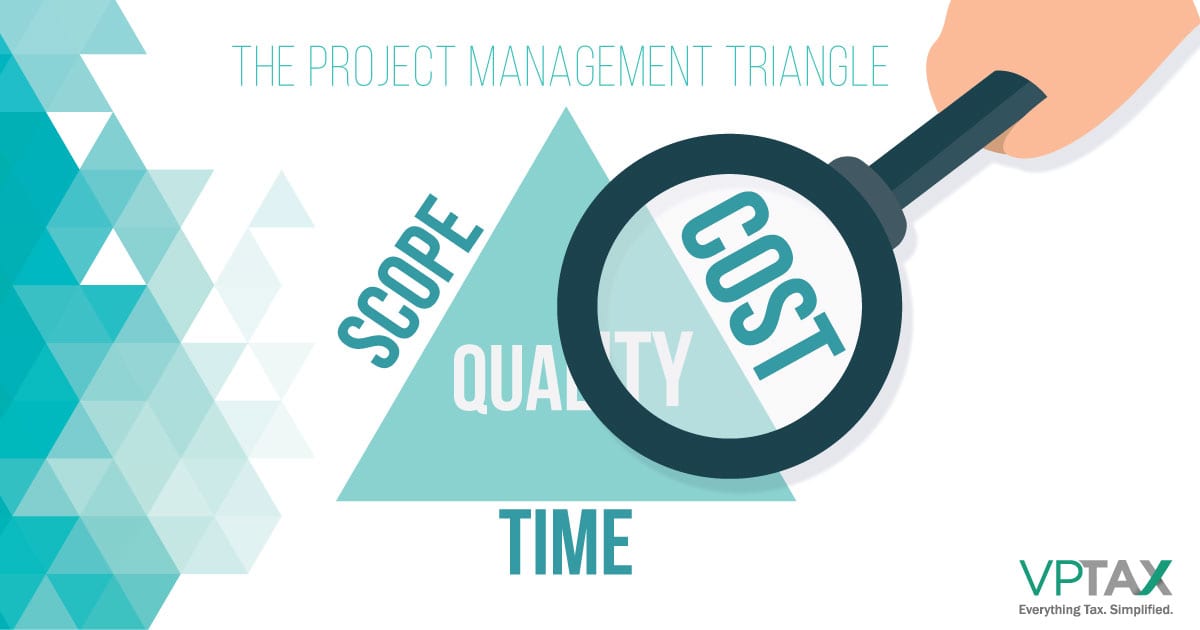

Ever heard of the project management triangle?

Ever thought about business taxation in the context of project management?

No? Why not?

Taxes are a cost of doing business, no more, no less. For real!

The three sides of the project management triangle are cost, time and scope. (Yes, scope, not quality. We’ll assume when it comes to taxes, quality is a must.)

This first of three blog will address the first side of the triangle; cost, such as…

- Out of pocket payments of taxes

- Cost of due diligence

- Out of pocket costs to administer taxes

- Opportunity costs

- Human cost

- Cost of failure

Minimizing tax payments is a great aim, one you shouldn’t underappreciate. Profitable companies benefit from including tax considerations in their business planning. But yet, because not all businesses are profitable, it’s not always the top priority.

The cost of a due diligence failure will be painful. It may not kill a deal, but it will make you wish you’d paid more attention earlier.

There are out of pocket costs to prepare tax returns and manage a business’s taxes. The cost likely includes amounts paid to third-party advisors as well as the utilization of internal resources. Tax management should be budgeted. When forecasting, companies typically anticipate tax expense and payments to the government. It’s rare that a company without an internal tax department sets a budget for tax management. Making the effort to establish a tax management budget helps prioritize projects and control spending.

Opportunity costs play a huge role in tax management. Most financial managers lack in-depth knowledge of the spectrum of taxes currently impacting their business as well as taxes likely to impact their business in the future. As a result, they have to rely on third-party providers. Reliance on a third party who’s revenue goals are impacted by your spending may be a conflict of interest. This should be regarded with the appropriate level of skepticism.

Human costs are often difficult to measure. While it may be relatively easy to quantify hours spent gathering tax data for the tax returns, it is not so easy to quantify the cost benefit to the employees of working with the same tax professionals year in and year out.

Imagine the cost savings with having tax professionals who teach your staff, not the other way around?

And finally, what is the cost of failure? More taxes? Penalties and interest? Your job?

See all posts in the Project Management Triangle series.