VPTax News & Content

Welcome to the world of all things tax. Instead of stuffy, hard to understand articles we have curated news and content that is up-to-date and easy to read. Filter by category, topic, or most recent. We want to share our knowledge with YOU so you can have the tools to help your business grow!

Digital asset tax: Key concerns companies must consider

(authored by RSM US LLP) Frank O’Connor, a senior director in RSM’s tax practice, discusses key concerns across technical tax and tax information reporting for digital assets.

Read More

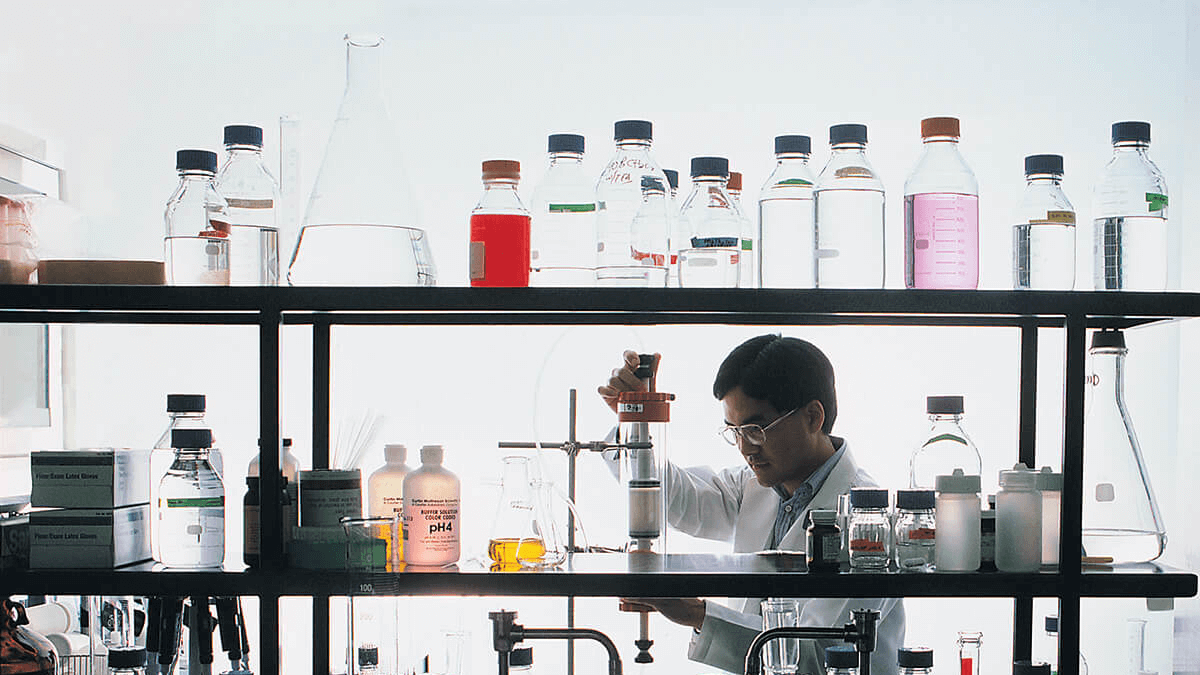

FAQ: Capitalization and amortization of R&D costs under new section 174 rules

(authored by RSM US LLP) See how the new required tax treatment of R&D costs under section 174 affects federal, state, and international taxes, as well as software development.

Read More

M&A considerations resulting from the new required tax treatment of R&D costs

(authored by RSM US LLP) New requirements to capitalize and amortize R&D costs are affecting M&A buyers by introducing costs and tax liabilities.

Read More

Tax Court rules that IRS lacks authority to assess penalties under section 6038(b)

(authored by RSM US LLP) On April 3, 2023, the Tax Court held that the IRS lacks authority to assess penalties under section 6038(b).

Read More

ASC 740: Q1 2023 Provision Considerations

(authored by RSM US LLP) A roundup of global income tax considerations and changes in tax law for corporations preparing income tax provisions under ASC 740 for the first quarter of 2023.

Read More

RSM again calls on Congress to address problematic changes to R&D tax law

(authored by RSM US LLP) RSM has submitted a second comment letter to Congress addressing the requirement to capitalize and amortize R&D expenditures under section 174.

Read More

R&D continues its losing streak in court

(authored by RSM US LLP) IRS continues to win cases challenging the research and development (R&D) credit. Specificity and supporting documentation remain tantamount to sustaining R&D credits.

Tax withholding for equity compensation

(authored by RSM US LLP) Employment and income tax withholding rules for equity compensation.

Read More

South Dakota drops Wayfair transaction threshold

(authored by RSM US LLP) First state to adopt economic sales tax nexus eliminates 200-transaction threshold providing remote sellers more certainty in determining nexus.

Read More

Income tax provision considerations for financial statement preparers

(authored by RSM US LLP) Financial statement preparers should consider the impact of new tax laws and regulations on income tax calculations and disclosures in their 2022 financial statements.

Read More